Here at LeBlond Ltd., we take pride in providing our customers with the highest quality metal-cutting lathes, grinders, mandrels and other related machine tool equipment. We also like to keep our customers and prospects informed with the latest news and information about our specialized industry. This particular blog article discusses a substantial IRS tax incentive that you might not be familiar with: The Section 179 Tax Deduction.

How Section 179 Works

When you purchase or finance machine tool equipment that qualifies for the Section 179 Tax Deduction, you can write off a certain amount of the total cost. The only stipulation is that the machine tool equipment must be acquired and put into use on or before the last day of the year. For the current Section 179 deduction limits and list of eligible equipment, visit the IRS website.

Act Now

Now is the time to consider getting new or upgraded machine tool equipment for your business. Prior to making any purchases, make sure you check the IRS Section 179 web page to see the different types of equipment that qualify. Another good recommendation is to consult with your tax professional, as he or she is most likely well-informed with Section 179 and can let you know if the machine tool equipment you want to acquire is eligible for the IRS deduction. Finally, the Section 179 Tax Deduction works with cash purchases and equipment leasing programs. Take a look at your finances and select the option that works best with your available capital.

This Section 179 article was written exclusively for LeBlond Ltd. by small business loan provider Balboa Capital.

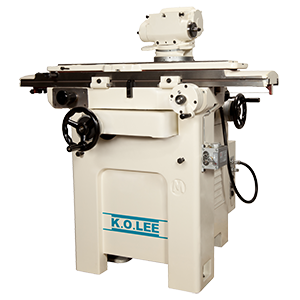

If you are interested in purchasing new K.O. Lee Economy Mandrels offered by LeBlond Ltd. or require OEM parts for your LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, call LeBlond Ltd. at (888) 920-9852. If you are interested in new LeBlond or K.O. Lee machines, call LeBlond Ltd. at (888) 920-9852.