It’s been a rough year for orders of machine tools in the United States, measured by the U.S. Manufacturing Technology Orders (USMTO) report issued monthly by the trade group Association for Manufacturing Technology (AMT).

For example, orders dropped 10.2% in August. September, however, saw U.S. machine tool orders get off the mat, as orders for new machine tools rose to $321.77 million, an increase of 10.9% from August, according to American Machinist.

Don’t chalk up the W yet for U.S machine tool companies, as the September 2015 results are 49.6% lower than September 2014 U.S. machine tool orders. The latter result, however, is with a caveat as this month coincided the staging of the International Manufacturing Technology Show (IMTS) in Chicago. The IMTS is the Godzilla of global manufacturing and skewed the U.S. machine tool orders artificially upward for September 2014.

American Machinist cites AMT’s reasons for the soft manufacturing numbers in 2015 and murmurs of hope:

In its announcement, AMT listed energy costs, a stronger dollar, and a generally weak global economy as factors discouraging capital investment by manufacturers. But, it also noted there are also factors that should give businesses and investors confidence in the current economic improvement. Among these, it listed a continued expansion of manufacturing activity (77 consecutive months though October 2015, as measured by the Institute for Supply Management), a narrowing U.S. trade deficit; and a new two-year federal budget agreement, reached in October.

Another metric for U.S. manufacturing –cutting tool consumption — showed less hope in September as manufacturers in the United States bought $170.8 million worth of cutting tools, a drop of 1.3% from August as well as a decrease of 11.7% from September 2014 results, according to American Machinist in a separate article.

What is the difference between the Cutting Tool Market Report (CTMR) and the USMTO? The former is a better gauge of present demand in U.S. manufacturing or “index of current business activity” while the latter “measures new orders for machine tools as an indicator of businesses’ confidence in the sector,” according to Robert Brooks of American Machinist.

So, according to these reports, the U.S. machine tool industry might have soft demand presently but the outlook for 2016 looks brighter.

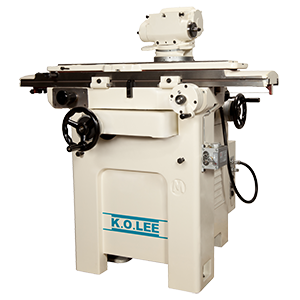

Don’t miss LeBlond’s holiday promotion where you can save up to 15% off or as much as $9,600 off heavy-duty RKL manual lathes. Find out more about the offer here. If you’re interested in new K.O. Lee equipment or need original OEM parts for LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, fill out a contact form here.