Orders of U.S. machine tools fell again in May … for the third straight month.

Orders totaled $336.98 million and fell 13.2% less than April and 6.2% less than May of last year, according to the United States Manufacturing Technology Orders (USMTO) report written up in American Machinist.

May was the fourth of five months in 2015 in which orders of U.S. machine tools totaling dropped, signaling a lack of confidence in the market by machine shops and other industry players.

The USMTO is compiled by the Association for Manufacturing Technology (AMT) that also releases the Cutting Tool Market Report (CTMR) in conjunction with the U.S. Cutting Tool Institute. The latter also indicated a 5.8% drop in U.S. cutting tool consumption in May from April. Domestic manufacturers consumed $172.8 million worth of cutting tools, down 7% from May 2014, according to a different American Machinist article.

American Machinist reports the CTMR might be a more apt bellwether for a sagging U.S. machine tool industry:

According to the AMT and USCTI (who represent developers, manufacturers, and distributors of cutting tools and the machinery in which those tools are used to produce components and parts), cutting tools are the primary consumable used in manufacturing, and their analysis of cutting tool consumption offers an indicator of overall activity in U.S. manufacturing.

AMT President Douglas K. Woods blamed a struggling energy sector and lack of confidence by small manufacturers for the drop in May and an overall lackadaisical performance by the U.S. machine tool industry in 2015.

“In large part, the decline in manufacturing technology orders is due to smaller manufacturers feeling a sense of economic uncertainty and therefore hesitant to make any kind of capital investment,” said Woods.

“In addition, the energy industry has curbed its spending, accounting for about half of the year-to-date decline in orders, and aerospace did not perform as well as expected in the first quarter. We expect the downturn to ease thanks to strong performance in the automotive and medical industries, with industrial production and a stronger PMI also indicating resilience in manufacturing.”

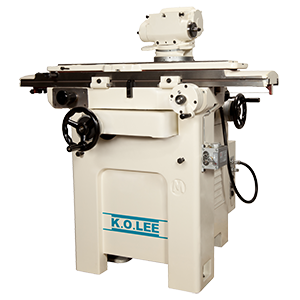

Don’t miss LeBlond’s promotion until September 15th where you can save up to 20% off or as much as $4500 off an RKL 1300 or 1500 Series metal lathe. Check out the offer here. If you’re interested in new LeBlond manual lathes, K.O. Lee grinders or need original OEM parts for LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, fill out a contact form here.