The downward spiral continues for new orders of machine tools and consumption of cutting tools in the United States in July.

U.S. machine tool orders dropped 11.8% in July 2015, amounting to $318.33 million for the month. This is an 11.1 % decrease from the year-ago results in July 2014, according to American Machinist.

Second Lowest Orders Month in Past 12 Months

The machine tools trade publication notes that the faltering July numbers were the second-lowest monthly total in the past 12 months. The information was gathered from the U.S. Machine Tool Orders (USMTO) report, compiled by the Association for Manufacturing Technology (AMT).

Another AMT report, the Cutting Tool Market Report (CTMR), issued with the U.S. Cutting Tool Institute, finds that consumption of cutting tools in the United States by manufacturers and machine shops dropped to $177.5 million in July 2015, down 5.9% from June and 5.6% from the July 2014 total, according to a different article in American Machinist.

The CTMR is a “‘leading indicator of both upturns and downturns in U.S. manufacturing activity,'” according to report sponsors as quoted in American Machinist.

International Concerns Slowing Down Domestic Market

Industry officials point to trouble signs in the world economy for the faltering state of manufacturing activity in the U.S.

“The mood among manufacturers right now is best described as ‘caution cube,’ said AMT President Douglas K. Woods.

Woods looks at “concerns around disruption in China, a drop in some key economic indicators like PMI and housing starts, and softening in large customer industries, including agriculture and energy.”

“Additionally, consumer confidence dropped in July, and the situation in Europe first with the Greek bailout and now the large influx of refugees is creating added uncertainty,” he continued. “Given all of that, it’s no surprise that manufacturers are wary about making large investments in capital equipment.”

North Central-East Region: Faint Signs of Growth

In the USMTO, the North Central-East region was the strongest of the six sectors in the United States where orders trickled to 0.3% higher in July over June 2014, amounting to $85.9 million. That number, however, was down 7.5% compared to July 2014.

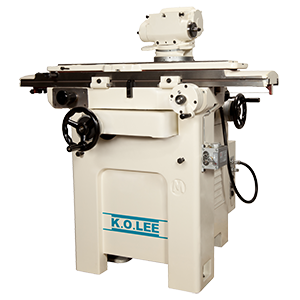

If you’re interested in new LeBlond or K.O. Lee equipment, call LeBlond Ltd. at (888) 532-5663 Ext. 202 or email LeBlond Ltd. GM Aaron Juillerat at [email protected]. If you need original OEM parts for LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, fill out a contact form here.