I am writing this on a powerful machine built by one of the most powerful companies on Earth that makes financing a purchase difficult.

I speak of Apple and my 15” MacBook Pro.

A little more than six months ago, I was in the market for a new computer. My old MacBook Pro was a relic. The Apple Store wasn’t even offering to repair the thing, it was so old. I inquired about financing over the phone. I bounced between 3-4 customer service agents and wasted about an hour filling out online forms. In the end, I was rejected and felt alienated by an application process that was bureaucratic and not very user-friendly.

The process of financing a manual machine tool purchase with LeBlond Ltd. is simple and effective in comparison to my nightmare with Apple. LeBlond Ltd. works with National Direct Lender Balboa Capital who has been in business for over two decades providing equipment leasing and small business loans.

Below are three tips to successfully get to YES on your machine tool financing with LeBlond compiled from Balboa Capital Regional Manager Steve G. Babor:

1. Register with your Local Secretary of State

Your business needs to be a legitimate entity registered with your local Secretary of State to be approved by Balboa Capital. Here is an article from eHow with tips on registering with your local office.

The first thing to do is to see if you can register with your local Secretary of State online. Just Google this search term for relevant state government websites. Remember, it costs money to do this. In my home state of Florida, it costs $125 to register a new LLC with the Florida Department of State Division of Corporations.

2. Check your Credit Before Seeking Financing

Chances are your boss will let you know with plenty of lead-time that your company is considering purchasing a new manual machine tool. This is the time to check your corporate credit profile and personal credit report if applicable.

If you glance at your credit reports and spot errors, it optimally takes roughly 60 days to fix something. You want to act quickly before contacting Balboa Capital. If you’re a larger business that owns equipment and property, chances are your business credit profile will be sufficient.

If you’re a corner donut shop, you might only have a business credit card to measure your credit history. In this case, Balboa Capital will want to check your personal credit report as well. Here are some suggestions from the Federal Trade Commission on repairing your credit.

3. Lean Back and Relax

When applying for LeBlond Ltd. manual machine tool financing with Balboa Capital, rest assured that your equipment has extremely high collateral value that makes it easier to get an approval. Your LeBlond equipment is a hard asset whose value holds up over decades unlike something like software or computers that are obsolete in years.

Balboa Capital makes the process extremely easy and user-friendly. Check out the one-page application here. It takes all of three minutes to fill out a leasing or financing request for equipment up to $250,000 in value. Best of all, Balboa is fast. You get an answer back in as fast as 20 minutes!

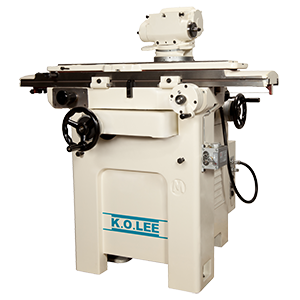

If you’re interested in a new LeBlond or K.O. Lee machines or interested in original OEM parts for LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, call LeBlond Ltd. at (888) 532-5663.

If you are interested in contacting Balboa Capital regarding LeBlond machine tool financing, call Steve G. Babor at (877) 407-7927.