April showers … May flowers?

U.S. manufacturer machine tool orders of new metal cutting and metal forming equipment were soggy in April, totaling $384.81 million. This is an 8.1% drop from a stronger March and a 1.0% decrease from April 2014, according to American Machinist.

These numbers are drawn from the U.S. Manufacturing Technology Orders (USMTO) issued by the Association for Manufacturing Technology (AMT).

The USMTO shows $1.46 billions of U.S. orders of machine tools for the nascent four-month period of 2015, an 8.5% drop from the same time span in 2014.

American Machinist smells a soft market with the April USMTO report:

AMT notes that investments in machine tools are an indicator of manufacturing confidence because of their role in the production of engineered components … Although the manufacturing technology orders figures for any single month are inconclusive as to overall trends, the April figures represent the third monthly decline in four months of the current year, and the fourth monthly decline in the past six months.

If the USMTO reflects future trends, the Cutting Tool Market Report (CTMR), (another AMT report compiled with the U.S. Cutting Tool Institute), reflects “boots on the ground” or “manufacturing activity at the current time,” according to another article by American Machinist.

The CTMR shows domestic manufacturers ordering $183.5 million of cutting tools in April, a 7.9% decline from March and 4.6% drop from April 2014.

AMT President Douglas Woods partially blames a strong dollar’s deleterious affect on exports as a reason for the sagging U.S. machine tools market.

“Right now capital equipment makers are feeling the effects of a stronger dollar, which creates a drag on exports, and lower oil and natural gas prices, which means less spending on equipment investments from the energy industry,” said Woods.

“But, what is a negative now should help us later. Imported components for capital equipment are costing less, and businesses will accumulate savings from lower fuel prices in the coming months, meaning more money for capital investment. We believe investment in manufacturing will remain steady, and overall performance for the year will be as strong as we saw in 2013 and 2014.”

So it rained hard on U.S. orders for machine tools in April. Hopefully, we’ll have flowers in May.

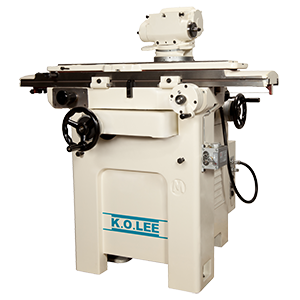

If you’re interested in new LeBlond manual lathes, K.O. Lee grinders or need original OEM parts for LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, fill out a contact form here.