Manufacturing is up. Manufacturing is down. Which is it and how does this affect the machine tool market?

According to a jobs report article last week in The New York Times, “the manufacturing sector, often viewed as a barometer for the broader economy, lost 6,000 positions in June.”

So manufacturing is down …

Not according to Industy Week that reports this week:

New orders for manufacturing technology climb to $430.06 million, adding an unexpected boost late in a slow year. New orders for manufacturing technology jumped to $430.06 million in May, closing the gap on what has been a slow year for sales. According to AMT – The Association for Manufacturing Technology – this total represents a 13.6% from April and brings the year-to-date total to about $2.09 billion.

So manufacturing technology is up but manufacturing in general is down. Sales are up in May, but down in June …

I’m confused! And just why should we in the machine tools market pay attention to manufacturing at all?

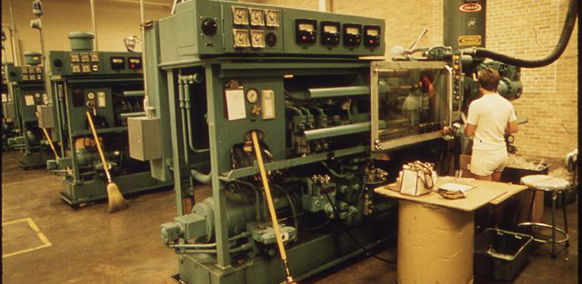

As you might imagine, the machine tool industry has strong ties to American manufacturing.

Daniel Twarog of the North American Die Casting Association (NADCA) reports that machine tool companies are part of the regional manufacturing supply chain where 90% of NADCA member companies sell to North American manufacturers like the auto industry.

Die casting companies are increasingly becoming “first tier suppliers” to the automotive industry and other sectors by machining parts that go directly into vehicles on the assembly line. In the past, there was a middle-man, “a guy who did the CNC machining,” according to Twarog.

So machine tool companies like a tool & die operation need to pay attention to growth trends in American manufacturing. That is obvious. But is American manufacturing up or down?

We turned to Chad Moutray, Chief Economist with the National Association of Manufacturers (NAM), for answers.

“We’ve seen weakness in the manufacturing sector since last summer,” said Moutray. “If you look at it by a year-to-year basis between June 2012 and June 2013, manufacturing only added 29,000 workers during that timeframe. That was only 1% of total workers added nationally during that time.”

Moutray cites a drop in the export market as a reason for the softness in the American manufacturing sector. Europe is in a recession and the Chinese are purposely slowing their economy, weakening U.S. exports to these huge markets.

The NAM economist also reports that domestic issues are undermining American manufacturing. The 2% payroll tax hike at the beginning of this year has lessened consumer demand. Also, manufacturers, like most American companies, are concerned about rising healthcare costs and regulations.

Moutray is bullish on manufacturing in the long run and cites the anticipated growth in the domestic energy market as a source of optimism. So manufacturing appears to be on the mend. This is good news for machine tool companies who are dependent on this vital American sector.

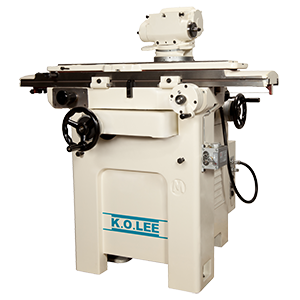

If you’re interested in new LeBlond or K.O. Lee machines or require original OEM parts for your LeBlond, K.O. Lee, Standard Modern, Johnson Press, Deka Drill and W.F. & John Barnes equipment, call LeBlond Ltd. at (888) 532-5663.